Introduction

Commerce is that aspect of business which is engaged in distribution of goods and services produced in Industry. So, commerce is totally dependent upon Industry. Industry refers to that part of business, which is engaged in producing and manufacturing of goods and services. The role of commerce starts after the role of industry gets over. Industrial activity i.e. producing goods and services is of no use unless it is sold to ultimate consumers. Commerce holds an important position in the economy. Commerce bridges the gap between producers and consumers by exchange of goods and services for money or money’s worth.

Commerce is a theory subject which is new to the students although buying and selling is a part of our day to day life. The commerce field includes subject like book-keeping , secretarial practice, organisation of commerce and management, economics, law, accountancy, marketing and human resource management etc.

Commerce has become the lifeline of every country. The level of development and the standard of living of the people are linked to the state of commerce in a particular country.

Education for commerce must therefore embrace educational facilities for those preparing for or engaged in business occupations of every kind, professional or otherwise, from office routine such as typewriting and shorthand to the positions of great responsibility.... .It includes education for wholesale and retail trade, for import and export trade, for transport and shipping, for general commerce, for profession so-called, for higher functions of management and administration.

We need accounting because it's the only way for the business to grow and flourish. Accounting is the backbone of the business financial world. After all, accounting was created in response to the development of trade and commerce during the medieval times. Accounting as an organized method for record keeping has been around almost as long as the trade and business industries. Another interesting fact is the knowledge and principles upon which the first accounting practices were established, have changed very little in the many hundreds of years that accounting has been in use. The concepts of assets, liabilities, expenses and income and the need to reconcile these areas is still the basis for all accounting functions today.

In Commerce education, a student is exposed to the environment of the business world. It is helpful for preparing them for self-employment and developing in them the entrepreneurial abilities. It also inculcates practice orientation among the students. It makes them know about the importance of applying economic principles while making business decisions. It makes them aware of social, economic and political problems relating to business concerns. It teaches them to face the market situation, to adapt themselves to the present circumstances. Moreover, it helps them to meet the global competition. It teaches them to how to manage the things/ works in business and as well as in their daily life routine so that works get completed with quality in it. they give equal time to things which are more important in their life. This will help in accepting the change in their life or work

Definition of Commerce:

We need accounting because it's the only way for the business to grow and flourish. Accounting is the backbone of the business financial world. After all, accounting was created in response to the development of trade and commerce during the medieval times. Accounting as an organized method for record keeping has been around almost as long as the trade and business industries. Another interesting fact is the knowledge and principles upon which the first accounting practices were established, have changed very little in the many hundreds of years that accounting has been in use. The concepts of assets, liabilities, expenses and income and the need to reconcile these areas is still the basis for all accounting functions today.

In Commerce education, a student is exposed to the environment of the business world. It is helpful for preparing them for self-employment and developing in them the entrepreneurial abilities. It also inculcates practice orientation among the students. It makes them know about the importance of applying economic principles while making business decisions. It makes them aware of social, economic and political problems relating to business concerns. It teaches them to face the market situation, to adapt themselves to the present circumstances. Moreover, it helps them to meet the global competition. It teaches them to how to manage the things/ works in business and as well as in their daily life routine so that works get completed with quality in it. they give equal time to things which are more important in their life. This will help in accepting the change in their life or work

Definition of Commerce:

Concrete definition of commerce:

“Commerce is that part of the business which is concerned with the exchange of goods and services and includes all those activities which directly or indirectly facilitate that exchange.”

“Commerce is that part of the business which is concerned with the exchange of goods and services and includes all those activities which directly or indirectly facilitate that exchange.”

According

to James Stephenson

“Commerce

is an organized system for the exchange of goods between the members of the

industrial world.

In book keeping, there are various topic and sub topic which deals with different aspects of a business. Some of them are basic rule of accounting, financial statement of any business or companies, bank statement, and source document for accounting etc. Book keeping is totally practical oriented subject, so students need the practical knowledge for some topics like identifying the items as Assets, Liabilities, Income and expenditure, bank reconciliation statement, journal entries, ledger and trial balance etc. Students started leaving or skipping the topic for examination mention above. Even teacher find the some topic very difficult to teach imaginary/concrete to students.

Commerce renders an important service in production and distribution of goods and services. The goods produced not only in different parts of a country but also in other countries are made available to the users with the help of commerce. It has enabled countries or areas to concentrate in the production of those goods for which they are specialised.

The producers are relieved of the marketing botherations and they use all their energies on accelerating production. Commerce helps in taking these goods to the users at various places. People are able to buy goods produced anywhere in the world.

Different countries have specialised in certain goods. They supply these goods to other countries and get their requirements from outside. Various agencies help in internal and external trade. The development of commerce has accelerated the pace of all round development.

The importance of commerce is to satisfy the human needs by providing different varieties of goods to customers, increase in the standard of living of a person by increase in the salary of a person, giving employment to a person/ individual by establishing a business or expanding the business. So, as the business expanding, it will lead to increase in wealth and income of person which indirectly lead to increase the national income of the country. It increase the international trade. It lead to more development of industrial sector, this effect on the other sector to grow.

There are a number of hindrances in undertaking trade. These may relate to transportation of goods, raising of finances, storing of goods for future consumption etc. These hindrances necessitate the study of various modes of transport, banking activities, warehousing and insurance facilities. All these facilities will help in the development of commerce. Both internal and external trade needs the use of cheques, bills of exchange, promissory notes, hundis, etc. The knowledge of drawing negotiable instruments is essential in financing the trade.

The customers will have to be made aware of the availability of goods and services in the market. The advertisement and salesmanship will help in promoting the products. Advertisements are playing an important role in the growth of trade. So these Medias have become an indispensable part of commerce.

The communication services play a vital role in the promotion of business activities. The producers and traders need information about the terms and conditions of buying and selling, movement of goods in transit and information regarding payments. Whole of this information is sent through communication devices of post office, telephone, telex, etc.

A number of time saving office devices like computers have also become a part of commerce. In a growing industrial world, marketing has become an important area. The activities like buying, assembling, grading, branding, and packaging also need proper emphasis in commerce.

Statement of the problem

“A study of the difficulties faced by XI std commerce students in learning the subject ‘book-keeping and accountancy.’”

Need of the study

The researcher selected this topic i.e., difficulties faced by students in understanding the concept of book keeping and accountancy. Since, there are few concepts that students should know for smooth business or running a business. There are concepts useful not only in business but in daily life also which they practice on a regular basis. Individual fails to understand the concept then he/she may not find the right company to invest their money. There are some concepts that they use before they start with accounts, but still they are not much clear with it.

The base of accounting is not clear and understood then constructing or building more knowledge will lead to misunderstanding or incomplete understanding of concepts.

For Example: Student finds it difficult to understand the transaction in pass book of bank Debit and credit side. Some students try to understand it whereas others didn’t understand the concept. So, they leave the concepts which are very important part of their life. These are small things which everyone has to understand because every person has to earn the money. They should know where their money is going and coming from.

Aim of the Study

·

To find out the difficulties faced by students in book-keeping &

accounting.

Objectives

·

To study the difficulty in basic concepts of book-keeping and

accountancy.

·

To study the difficulty in fundamental of double entry.

·

To study the difficulty in source document.

·

To study the difficulty in journal entries.

·

To study the difficulty in subsidiary books.

·

To compare the difficulties in basic concepts, fundamental, source

documents, journal entries and subsidiary books.

Conceptual & Operational Definition

Study:

A state of contemplation. The devotion of time and attention to gaining knowledge of an academic subject, especially by means of books.

In this research, it means gaining information on the difficulties faced by students in studying Book keeping & accountancy.

Difficulties:

The state or condition of being difficult.

In this research it means problems of understanding and solving questions in book keeping and accountancy.

Students:

A person who is studying at a university or other place of higher education.

In this research it means pupils studying in Std.XI.

Learning:

The acquisition of knowledge or skills through study, experience or being taught.

In this research learning refers to acquiring knowledge and developing an understanding of Book keeping and accountancy.

Subject:

A branch of knowledge studied or taught in a school, college or university.

In this research, subject refers to Book keeping and accountancy of Std. XI as per Maharashtra state syllabus.

Book keeping:

Book-keeping is a systematic recording and organising of financial transactions in a company.

In this research, book-keeping means recording all the transactions in business date wise.

Accountancy

Accountancy is the practice of recording, classifying, and reporting on financial transactions for a business. It provides feedback to management regarding the financial results and status of an organization.

In this research, accountancy means classify, organising the business transactions as per rule and also interpret the transactions, on that basis decision are taken for company welfare.

Importance of the Study

The importance of the research is to find the cause of the problem, once we get the root of the problem then side by side we get the solution of the problem. So, once the researcher knows where the students have the problem then only researcher will find the different ways of solving it. Book keeping and Accountancy is totally a practically oriented subject, teachers have to use different teaching technique for different topic, field visit like bank, Corporate society, partnership firms, multi-national companies. Even through making leader in the class for managing the class. In college there can be different clubs for each topic and how that effect in different sector as well as in day to day life of a person.

Parents can involve their children few things i,e., any transaction related to bank, different kind of bills, about buying the different items, final statement of the society, managing their own things, etc. Society can have different function so children can get knowledge of different field and how they will apply in their own life.

Scope of the Study

·

The scope of the study is CKT Junior College of commerce at New Panvel.

Other Colleges in and around New Panvel are not considered.

·

College with English medium is selected for study. Other medium of

colleges is not considered.

·

Only XI std. students are selected for the study. Other students are not

considered in College

·

Students are selected from Maharashtra SSC Board only. CBSE and other

Board students are not considered.

Methodology Used

In this research the survey method was used. Survey methodology

studies the sampling of individual units from a population. A tool used for

survey is a set of predetermined questions for all respondents. It serves as a

primary research instrument in survey research.

·

Sample size: 50 students were taken for this study/ action

research.

·

Tools employed for the study: A tool is a form containing

questions to which a subject or subjects respond. The information gained from

the questionnaire is often subjected to statistical analysis. Questionnaires

can be used to examine the general characteristics of a population, to compare

attitudes of different groups and to test theories. Questionnaires appear

simple but they are very difficult to compile in a manner which establishes

reliability and validity.

·

The Researcher has used an opinionnaire to collect data. It is based on a 3-point

Likert scale which has options, “Agree, Disagree and Can’t say”.

Analysis and Interpretation of Data

Table 1:

Basic concepts of

book-keeping and accountancy:

Aspects

|

Student

responses

|

|||||||

Agree

|

Disagree

|

Can’t

say

|

Total

no. of respondents

|

|||||

No.

|

%

|

No.

|

%

|

No.

|

%

|

No.

|

%

|

|

To

understand the concepts

|

26

|

52

|

18

|

36

|

06

|

12

|

50

|

100

|

To

transfer the ledger balances to trial balance

|

21

|

42

|

19

|

38

|

10

|

20

|

||

To

understand the transaction of bank and cash in bank reconciliation statement

|

20

|

40

|

20

|

40

|

10

|

20

|

||

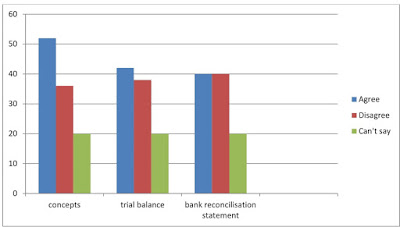

Figure-1

In the above diagram, X axis represents the aspects of difficulty in concepts of book-keeping and accountancy and Y axis represents percentage of the students. Blue colour represent the “agree”, red colour represent “disagree” and green colour represent “can’t say”.

As per figure 1, 52% students agree that they face difficulty in understanding the concept of book-keeping and accountancy whereas 36% of students don’t face any difficulty in understanding the concepts of book-keeping and accountancy and 20% of students are unsure whether they have difficulty in understanding the concepts of book-keeping and accountancy.

42% of students agree that they face difficulty in understanding the concept of trial balance whereas 38% of students don’t face any difficulty in understanding the concept of trial balance and 20% of students are unsure whether they have difficulty in understanding the concept of trial balance.

It also shows that 40% of students agree that they face difficulty in understanding the concept of bank reconciliation statement whereas 40% of students don’t face difficulty in understanding the concept of bank reconciliation statement and 20% of students are unsure whether they face difficulty in understanding the concept of bank reconciliation statement.

Table 2:

Fundamental of Double entry

Aspects

|

Student

responses

|

|||||||

Agree

|

Disagree

|

Can’t

say

|

Total

no. of respondents

|

|||||

No.

|

%

|

No.

|

%

|

No.

|

%

|

No.

|

%

|

|

To

understand the accounting process

|

20

|

40

|

23

|

46

|

7

|

14

|

50

|

100

|

To

categorize assets, liability, income, expenditure

and capital

|

17

|

34

|

15

|

30

|

18

|

36

|

||

To explain the effects of accounting

equations from transactions given

|

20

|

40

|

14

|

28

|

16

|

32

|

||

To form accounting equations on bases of

transactions

|

13

|

26

|

25

|

50

|

12

|

24

|

||

To classify different types of accounts (Personal,

Real and Nominal)

|

27

|

54

|

12

|

24

|

11

|

22

|

||

To analyse the transaction in a tabular

form

|

14

|

28

|

25

|

50

|

11

|

22

|

||

Figure 2

In the above diagram, X axis represents the aspects of difficulty in concepts of book-keeping and accountancy and Y axis represents percentage of the students. Blue colour represent the “agree”, red colour represent “disagree” and green colour represent “can’t say”.

As per figure 2, 40% of students agree that they face difficulty in understanding the accounting process whereas 46% of students don’t face any difficulty in understanding the accounting process and 14% of students are unsure whether they have difficulty in understanding the accounting process.

34% of students agree that they face difficulty to categorise the items as assets, liability, income, expenditure and capital whereas 30% of students don’t face any difficulty to categorise the items as assets, liability, income, expenditure and capital and 36% of students are unsure whether they face difficulty to categorise the items as assets, liability, income, expenditure and capital.

40% of students agree that they face difficulty in understanding the effects of accounting equations from transactions whereas 28% of students don’t face any difficulty in understanding the effects of accounting equations from transactions and 32% of students are unsure whether they face difficulty in understanding the effects of accounting equations from transactions.

26% of students agree that they face difficulty to form accounting equations on bases of transactions whereas 50% of students don’t face any difficulty to form accounting equations on bases of transactions and 24% of students are unsure whether they face difficulty to form accounting equations on bases of transactions.

54% of students agree that they face difficulty in understanding the different types of accounts (Personal, Real and Nominal) whereas 24% of students don’t face any difficulty in understanding the different types of accounts (Personal, Real and Nominal) and 22% of students are unsure whether they face difficulty in understanding the different types of accounts (Personal, Real and Nominal).

It also shows that 28% of students agree that they face difficulty to analyse the transaction in a tabular form whereas 50% of students don’t face difficulty to analyse the transaction in a tabular form and 20% of students are unsure whether they face difficulty to analyse the transaction in a tabular form.

Table 3:

Source documents

Aspects

|

Student

responses

|

|||||||

Agree

|

Disagree

|

Can’t

say

|

Total

no. of respondents

|

|||||

No.

|

%

|

No.

|

%

|

No.

|

%

|

No.

|

%

|

|

To

discriminate between vouchers, receipt

|

17

|

34

|

20

|

40

|

13

|

26

|

50

|

100

|

To

discriminate between cash memo and credit memo

|

17

|

34

|

22

|

44

|

11

|

22

|

||

To

discriminate between Debit note and Credit note

|

19

|

38

|

19

|

38

|

12

|

24

|

||

To discriminate between crossed cheque,

order cheque and bearer cheque

|

19

|

38

|

25

|

50

|

06

|

12

|

||

Figure 3:

In the above diagram, X axis represents the aspects of difficulty in concepts of book-keeping and accountancy and Y axis represents percentage of the students. Blue colour represent the “agree”, red colour represent “disagree” and green colour represent “can’t say”.

As per figure 3, 34% students agree that they face difficulty to discriminate between vouchers and receipt whereas 40% of students don’t face any difficulty to discriminate between vouchers and receipt and 26% of students are unsure whether they have difficulty to discriminate between vouchers and receipt.

34% of students agree that they face difficulty to discriminate between cash memo and credit memo whereas 44% of students don’t face any difficulty to discriminate between cash memo and credit memo and 22% of students are unsure whether they have difficulty to discriminate between cash memo and credit memo.

38% of students agree that they face difficulty to discriminate between Debit note and Credit note whereas 38% of students don’t face any difficulty to discriminate between Debit note and Credit note and 24% of students are unsure whether they have difficulty to discriminate between Debit note and Credit note.

It also shows that 38% of students agree that they face difficulty to discriminate between crossed cheque, order cheque and bearer cheque whereas 50% of students don’t face difficulty to discriminate between crossed cheque, order cheque and bearer cheque and 12% of students are unsure whether they face difficulty to discriminate between crossed cheque, order cheque and bearer cheque.

Table 4:

Journal entries

Aspects

|

Student

responses

|

||||||||

Agree

|

Disagree

|

Can’t

say

|

Total

no. of respondents

|

||||||

No.

|

%

|

No.

|

%

|

No.

|

%

|

No.

|

%

|

||

To

making journal entries.

|

31

|

62

|

15

|

30

|

04

|

08

|

50

|

100

|

|

To

understand the adjustment related to discounts

|

14

|

28

|

21

|

42

|

15

|

30

|

|||

Figure 4:

Journal entries

In the above diagram, X axis represents the aspects of difficulty in concepts of book-keeping and accountancy and Y axis represents percentage of the students. Blue colour represent the “agree”, red colour represent “disagree” and green colour represent “can’t say”.

As per figure 4, 62% of students agree that they face difficulty in making journal entries whereas 30% of students don’t face any difficulty in making journal entries and 08% of students are unsure whether they have difficulty in making journal entries.

It also shows that 28% of students agree that they face difficulty in understanding the adjustment related to discounts whereas 42% of students don’t face any difficulty in understanding the adjustment related to discounts and 30% of students are unsure whether they have difficulty in understanding the adjustment related to discounts.

Table 5:

Subsidiary books

Aspects

|

Student

responses

|

|||||||

Agree

|

Disagree

|

Can’t

say

|

Total

no. of respondents

|

|||||

No.

|

%

|

No.

|

%

|

No.

|

%

|

No.

|

%

|

|

To

enter transaction in purchase, sale book

|

33

|

66

|

11

|

22

|

06

|

12

|

50

|

100

|

To

enter transaction in purchase return book and sale return book

|

14

|

28

|

22

|

44

|

14

|

28

|

||

To

discriminate between carriage inward and carriage outward

|

17

|

34

|

18

|

36

|

15

|

30

|

||

To enter the transaction in double column

cash book

|

22

|

44

|

21

|

42

|

07

|

14

|

||

To enter the transaction in cash and petty

cash book

|

26

|

52

|

14

|

28

|

10

|

20

|

||

Figure 5:

Subsidiary books

In the above diagram, X axis represents the aspects of difficulty in concepts of book-keeping and accountancy and Y axis represents percentage of the students. Blue colour represent the “agree”, red colour represent “disagree” and green colour represent “can’t say”.

As per figure 5, 66% of students agree that they face difficulty in entering the transactions in purchase and sale book whereas 22% of students don’t face any difficulty in entering the transactions in purchase and sale book and 12% of students are unsure whether they have difficulty in entering the transactions in purchase and sale book.

28% of students agree that they face difficulty in entering the transaction in purchase return book and sale return book whereas 44% of students don’t face any difficulty in entering the transaction in purchase return book and sale return book and 28% of students are unsure whether they have difficulty in entering the transaction in purchase return book and sale return book.

34% of students agree that they face difficulty to discriminate between carriage inward and carriage outward whereas 36% of students don’t face any difficulty to discriminate between carriage inward and carriage outward and 30% of students are unsure whether they have difficulty to discriminate between carriage inward and carriage outward.

44% of students agree that they face difficulty in entering the transaction in double column cash book whereas 42% of students don’t face any difficulty in entering the transaction in double column cash book and 14% of students are unsure whether they have difficulty in entering the transaction in double column cash book.

It also shows that 52% of students agree that they face difficulty in entering the transaction in cash and petty cash book whereas 28% of students don’t face any difficulty in entering the transaction in cash and petty cash book and 20% of students are unsure whether they have difficulty in entering the transaction in cash and petty cash book.

Mean of agree statement

Table 6:

Comparison of difficulties in various chapters

Chapters

|

Means

|

Concepts of book-keeping and accountancy

|

22.33

|

Fundamental of Double entry

|

18.50

|

Source documents

|

18

|

Journal entries

|

22.50

|

Subsidiary books

|

22.40

|

Figure 6:

Comparison of difficulties in various chapters

In the above pie chart shows that students face more difficulty in basic concept of book-keeping and accountancy(22.33), Journal entries(22.50) and subsidiary books(22.40) as compare to other sub-topic i.e, fundamental of double entry(18) and source documents(18.50). It shows the means of each sub-topic of book-keeping and accountancy.

The students face more difficulty in journal entries a compare to basic concept of book-keeping and accountancy and subsidiary books. Students face more or less difficulty in basic concept of book-keeping and accountancy and subsidiary book. Students face less or same difficulties in fundamental of double entry and source documents.

Major Findings of the Study

The major findings of the study are as

follows:

·

There are more number of students who faced difficulties in basic

understanding of concepts of book-keeping and accountancy, trial balance, bank

reconciliation statement, to categorise the items as assets, liability, income

and expenditure and capital, effects of accounting equation, types of accounts,

to discriminate between debit and credit notes, journal entries, transaction in

purchases, sales book, petty cash book, double column cash book as compare to

students who face difficulties in understanding the accounting process, forms of accounting equation,

tabular form, to discriminate between voucher and receipt, memos, cheques,

adjustment related to discount,

transactions in purchase and sale return books, carriage inward and

outward.

·

There is more number of students who face difficulties in basic concepts

of book keeping and accountancy, journal entries and subsidiary books as

compare the students who face difficulties in fundamental of double entries and

source documents.

·

These difficulties are more in the above areas perhaps due to

ü Students were absent during the topic and they didn’t understand the topic next day.

ü Teachers fail to address the topic with their real life.

ü Teachers fail to create interest among the students during the lectures.

ü Sometimes the teaching goes beyond the boundary of student’s level of understanding.

ü Parents don’t take initiative to share their responsibility with students of bank or other payment of expense. To get real life experiences of different expenses and transaction in banks.

Suggestions

Commerce is totally practically oriented subject. Teacher should relate all topic with their real life so that they can be easy understand the topic. While teaching they can be different use of technique like making use of ITC, current examples of samples, creating different clubs as per students needs so that he/she understand it deeply, visit to different companies, bank, cooperative store and cooperative society etc,. Even there can be session or seminar or workshops on the topics. So, that the students gets the broader idea about the topics. There can be cooperative store in school and that store is run by students. Similarly with bank run in school and handled by students.

Students can be up to by knowing what is happening in world or reality, there can be bulletin board that can be filled with newspaper cut outs, magazine cut out etc. Even speech can be conducted by students in class on everyday basis. It can also be done through different competitions.

Conclusion

Researcher finds that students actually face difficulty in understanding the basic concept of book-keeping and accountancy. Even while conducting research students have difficulty due to reasons of not attending college and they do not understand what teacher is teaching to them. Teachers are restricted with traditional approach of study, they don’t focus on each type of learner in the class. Through lectures students only get theory knowledge of concept and on the basis of their own past experience. They can’t connect to the real life. This difficulty is arising from both the side of teacher as well as students. So, both have to understand a problem a find a alternative way for solving it.

Appendix

This data will be used only for research purpose. Please read the statements given below and put a tick in the appropriate column:

Class: XI

I face difficulties in the following aspects while

studying Book-keeping and Accountancy:

|

||||

No.

|

Aspects

|

Agree

|

Disagree

|

Can’t say

|

1

|

To understand the

concepts

|

|||

2

|

To understand the

accounting process

|

|||

3

|

To making journal

entries.

|

|||

4

|

To categorise assets, liability, income, expenditure and

capital

|

|||

5

|

To explain the effects of accounting

equations from transactions given

|

|||

6

|

To form accounting

equations on bases of transactions

|

|||

7

|

To classify different types of accounts

(Personal, Real and Nominal)

|

|||

8

|

To analyse the

transaction in a tabular form

|

|||

9

|

To discriminate

between vouchers, receipt

|

|||

10

|

To discriminate

between cash memo and credit memo

|

|||

11

|

To discriminate

between Debit note and Credit note

|

|||

12

|

To discriminate between crossed cheque,

order cheque and bearer cheque

|

|||

13

|

To enter

transaction in purchase, sale book

|

|||

14

|

To enter transaction in purchase return

book and sale return book

|

|||

15

|

To discriminate between carriage inward and

carriage outward

|

|||

16

|

To enter the

transaction in double column cash book

|

|||

17

|

To transfer the

ledger balances to trial balance

|

|||

18

|

To understand the transaction of bank and

cash in bank reconciliation statement

|

|||

19

|

To understand the

adjustment related to discounts

|

|||

20

|

To enter the

transaction in cash and petty cash book

|

|||

Bibliography

Textbook

ü

Organisation of Commerce and Management STD XI (Maharashtra State Board

of Secondary and Higher Secondary Education).

Websites

Hello ma'am, Can I get this action research

ReplyDeleteHi madam can igrt this action research please

ReplyDeleteNice Blog! Looking for commerce classes in Chandigarh? We offer comprehensive coaching for students pursuing Commerce at the school or college level, covering subjects like Accountancy, Business Studies, Economics, and Mathematics. These classes are designed for Class 11, Class 12, and competitive exam aspirants, providing conceptual clarity and practical problem-solving skills. With experienced faculty, updated study material, and regular tests, they ensure students excel in academics and build a strong foundation for higher studies like B.Com, CA, CS, and MBA.

ReplyDelete